Identity theft is one of the most alarming yet under-discussed problems affecting American consumers.

ElitePersonalFinance has created a list of 100 ways to prevent identity theft. Let’s start with the top 10 important of them.

| Tip: |

Action: |

To Do: |

Expected Results: |

| 1 |

Place a security freeze on your credit file. |

Request and pay for a freeze on your credit report from Equifax, Experian, or TransUnion. The bureau you notify will inform the other two of the request.

Check your state credit freeze laws and costs here! |

New creditors won’t be able to pull your file without your prior approval. This will prevent new account fraud. The only effective way for a fraudster to attack you at this point would be through your current credit accounts. |

| 2 |

Place a fraud alert on your credit file. |

To place a fraud alert, request with one of the three bureaus. The notified bureau will inform the others. You can place a 90-day fraud alert under the suspicion of identity theft. If you ever get an FTC Identity Theft Affidavit, you can place an extended 7-year fraud alert. |

This will put a ‘red flag’ on your credit file to warn creditors that your information might have been compromised. However, it will not guarantee that your information will only get passed to creditors by you. Learn more about a fraud alert. |

| 3 |

Subscribe to an identity theft protection plan. |

Join trusted ID theft protection companies. Review the best identity theft protection companies of July 2025 and choose one to join. |

You will get notified if there are any signs of identity theft. This includes potential account and information compromises. A good ID protection plan will also include identity theft insurance or a service guarantee; this helps a lot as you become liability-free. |

| 4 |

Subscribe to a credit monitoring plan. |

Join a credit monitoring service with instant alerts and tri-bureau credit monitoring, reports, and scores. Some of the best ID protection companies offer credit monitoring too! Review our best credit monitoring companies of July 2025 list to find one for you. |

A credit monitoring service ‘catches people at the door’ trying to break in, while ID protection detects them post-entry. A quality credit monitoring plan will ensure any slight signs of ID theft are caught and acted on right away. |

| 5 |

Create a backup of your wallet contents. |

Make a chart listing all your credit cards, identification cards, and other identifying and valuable possessions in your purse or wallet. Make sure to note the phone number/web page to report each card as lost or stolen. |

Note: If your passport was lost or stolen, you need to report it to the U.S. Department of State. This will give you something to fall back on if you become an identity theft victim. You will know what needs to be deactivated and where you need to contact. |

| 6 |

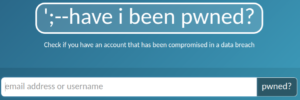

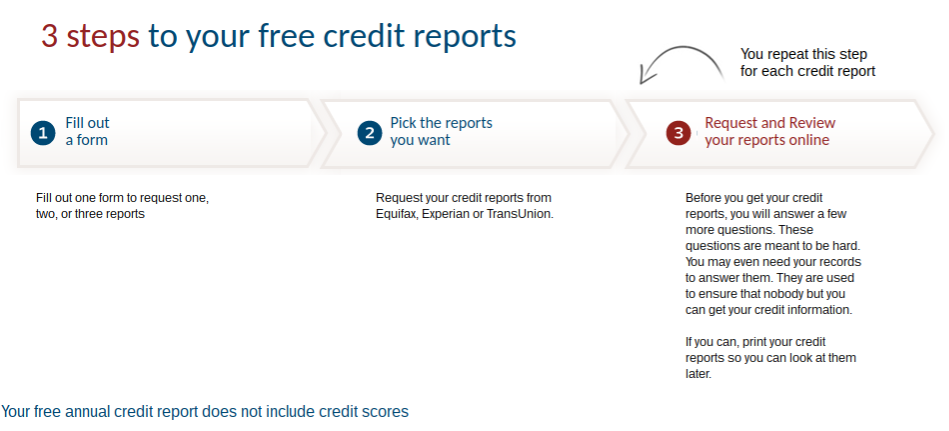

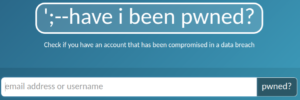

Make sure you’re not a data breach victim. |

Go to HaveIBeenPwned and check for your email address to see if you’re listed in any data breaches / online pastes. After searching for your email, click ‘Notify me when I get pwned’ to receive alerts whenever your info gets compromised. |

Millions of Americans have had their identity compromised without knowing it. HaveIBeenPwned will show you if any of your emails link to compromised website accounts. You know what to do from there! |

| 7 |

Start using safer payment methods online. |

Use Bitcoin, virtual gift cards, prepaid credit cards, and/or virtual wallets (ex. PayPal, Google Pay) to pay for stuff online. Avoid using your credit card directly as much as possible! |

The fewer places you put your credit card credentials (number, expiry, and CVC), the better. When you can pay through a third-party processor, it’s better that way instead of your credit card issuer. |

| 8 |

Shred any unneeded sensitive papers. |

Shred sensitive documents whenever you are certain they are no longer needed. When buying a paper shredder, make sure it’s powerful enough to shred plastic cards too. |

All you need is a shredder (unless you burn it!), and you have the power to destroy sensitive documents at any time. Take advantage of this power because you never know when your papers or home will get compromised. |

| 9 |

Avoid digitally storing sensitive information. |

Pick up an external hard drive or a USB stick to store your confidential data. Whenever you process important data, save it to upload it from your external device; copy what you currently have stored after you get it. |

Your computer (and cloud storage accounts!) makes it too easy for risky information to get archived and forgotten about. Having it all stored in an offline device is the safest way to go. |

| 10 |

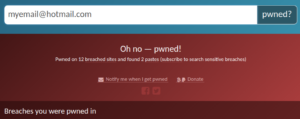

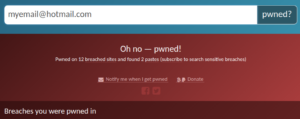

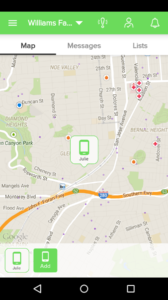

Get a free copy of your credit report. |

Go to AnnualCreditReport and request your free annual credit report from Equifax, Experian, or TransUnion You can check all your reports at once or space them out to get one report every four months. |

This is just to make sure your identity hasn’t already been stolen.

If you invest in a good credit monitoring service, you won’t need to worry about this; most give quarterly or monthly reports from all three bureaus. Note: AnnualCreditReport is the only website authorized by the US government to deliver the free annual credit report. |

We have even gone as far as to break up our advice into sections, in case you want to jump to some tips that are more likely to help you:

100 Ways To Can Prevent Identity Theft

Without further ado, here’s our ultimate list of identity theft prevention tips!

Section 1 – How to Prevent Identity Theft Completely

Anyone can become an identity theft victim. It takes a lot of work to ensure your identity is as safe as it can be. So, let’s look at how to prevent identity theft completely in the easiest ways possible. The following tips will apply to all, regardless of age and profession.

1) Put a Credit Freeze on Your File

Some people just wait until the damage is done to put a credit freeze on their credit file. This is not a mistake you should make; you have the right to request a ‘freeze’ on your file at any time. By doing so, you will make it so that you are required to verify (by phone) whenever you want your credit file to be shared with a specific party. This remains active until it is reversed.

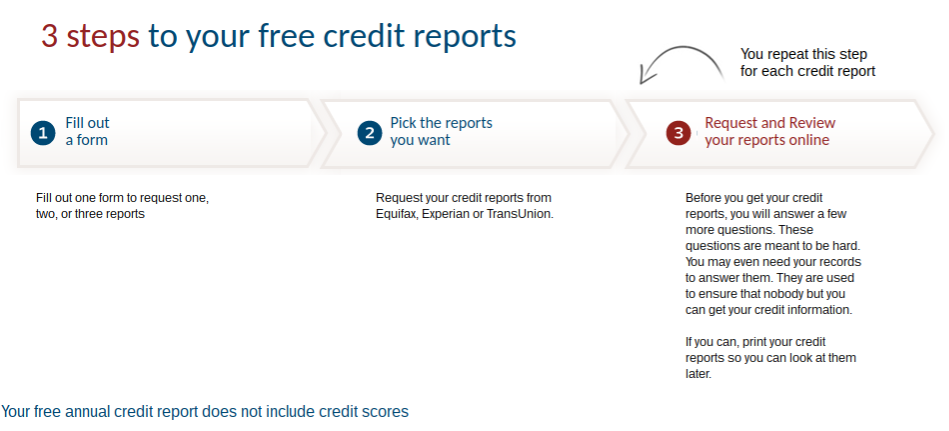

Learn more about credit freeze and how to place it.

2) Place a Fraud Alert

Aside from the credit freeze, there’s also a ‘fraud alert’ that can be placed on your credit report. This will notify lenders that your identity might have been compromised. This is a way of warning creditors to be weary when dealing with your info. It does not prevent any new or current lenders from pulling your file, but it’s always good to have — especially if your information has actually been stolen.

Learn more about fraud alerts and how to place them.

3) Get Identity Theft Protection Service

A lot goes into making sure your identity stays safe. The different protective layers necessary are varied and many. Your age, household status, and workplace can be what measures you to keep your identity safe. Meanwhile, an identity theft protection service wraps all possible methods of identity protection into one product. This can protect any adult; many top service providers even offer child protection plans for your little ones!

ElitePersonalFinancere reviews various identity theft companies. You can get a full run-through on what’s available by checking out our review piece: the best identity theft protection companies of July 2025.

4) Get Credit Monitoring

Identity theft protection services are helpful because they cover almost every possible entry point an identity thief could use. Yet, they do not cover the all-too-important factor of credit protection. People can steal your identity without leaving a trail; instead, the criminal could manipulate your identity to commit credit fraud. To catch this quickly, you need to invest in credit monitoring services.

Supposing you are interested in identity theft services, most big companies offer bundled plans that include credit monitoring. You can check our review of the best credit monitoring services of July 2025 to find the best plans with and without ID protection features.

5) Create a Wallet Backup

While you cannot literally back up your wallet (unless we’re talking about Bitcoin wallets!), you can still keep a digital or written copy of everything it contains. When doing this, you should write down the card number, type, and any relevant contact numbers for their support lines. This makes it easier to prevent your identity from getting stolen if your wallet or purse gets lost or taken.

Sounds like a hassle? It has to be because a wallet backup mobile app has security concerns.

Things to list: Credit cards, identification, medical cards, insurance cards, documentation, etc. Anything that reveals your full name, date of birth, current address, Social Security number, or any of your ID numbers should be viewed as dangerous info in the wrong hands!

Pro Tip. If your wallet gets lost or stolen while traveling abroad, you can report it to the Department of State by calling 1-877-487-2778 … this is a government-run organization that can help you, especially if you lost your passport and can’t get back home.

6) Make Sure You are not Already a Victim

You might have your sensitive information accessible on the Web, yet you just don’t know it. The damage could happen right after it gets released or months to years later. For instance, you could be one of the many million Americans who had their data breached in a website hack. This has happened on big sites like Ashley Madison, LinkedIn, MySpace, VK.com, and many others.

There is an easy way to see if your information is out on the loose. Just go to HaveIBeenPwned and search for your email address to find out.

If your information is on the loose:

If your information isn’t out on the World Wide Web:

Take it a step further and set up alerts, so you can find out instantly if your sensitive data reaches the Web!

To subscribe, just select the “Notify me when I get pwned” button after searching for your email address. Then go to your email and confirm your subscription, and you’ll be good to go.

7) Use Online Payment Methods (and Wallets)

Paying through PayPal gives you extra security, as the recipient does not receive your credit card information. Yet, you can go further by using an online wallet like Google Pay or even Bitcoin to secure your payment credentials. The alternative payment world is growing, and soon there will be no reliance on the old card payment system. This is something you should always keep an eye on because the flawed state of today’s credit world desperately needs to be fixed.

So if you are paying by credit card, your best bet is to first look for the option to pay via PayPal with your card. To do this, you need to look for the following option:

8) Shred Any Documents You Don’t Need

You should get into the habit of shredding your unneeded paperwork regularly. A paper shredder is not a big investment. Plus, you might even have the option of enjoying the departure of your bills and other nuisances by burning them in a fire pit. Either way, the point is that you do not want your personally identifying information to make it into the trash.

Seriously, shred your paperwork – previous statistics show that as much as 88% of stolen personal identifying information came from criminals rooting through the trash.

Again, another simple item from an office supply store or your nearest Walmart would be this:

What to shred?

- Junk mail.

- Unneeded receipts.

- Unneeded utility bills.

- Monthly bank/investment statement.

- Annual pay stubs / other employment documentation.

- Loan contracts.

- Rental contracts.

- Service contracts.

- Warranties.

- Car and home repair records.

- Membership documents.

9) Keep Your Documents off The Computer

It’s often necessary to store personal files on the computer, especially when building spreadsheets for tax purposes. Most information is never reviewed again and could just be deleted from your computer after being used the first time. If you are weary, just get a USB stick to store your personal documents on. You do not want to store personal information over the long term on your main computer, as it essentially becomes a treasure chest for hackers.

Invest in one of these to store your important stuff (and not cloud storage, the most breachable storage ever!):

USB stick that works too!

10) Obtain a Copy of Your Credit Report

If you are not proactive with tracking your credit file, now would be a good time to start. This means more than just getting credit monitoring assistance; take the time to obtain and review your credit report. Look for any discrepancies, stuff that looks inaccurate or fraudulent, and make the error known to the credit report bureaus.

Be careful, as information must also match your credit reports from the three main bureaus, including Equifax, Experian, and TransUnion.

You can easily obtain your credit report for free through AnnualCreditReport once a year. If you space out your requests by the bureau, you can get one of your reports every four months of the year.

11) Don’t Share Your Personal Information Online

It sounds like common sense, but more often than not, victims put themselves in that position. We covered how social media helped identity thieves, and the exemplified cases would astound you in a recent post. Some were so unacknowledged that they shared their credit card, social security number, and even bank checks on the Web.

It does not matter if you use Facebook, Instagram, or Twitter. You should not ever assume that your personal information is private. Even in your private inbox, if a hacker ever breaks in, there could be endless identifying details about yourself that were not deleted. So, don’t just use common sense. Go the extra mile and keep your private stuff to yourself!

We’ll cover more advanced tips on protecting your social accounts later in this guide, in our section on protecting your identity online.

12) Avoid Giving out Identifiable Information to Other People

In the identity theft world, any details a criminal can use to target you are personal identification information. This includes details like your banking information, credit card details, driver’s license and health card numbers, and your social security number. In most cases, the person or website requesting it does not need the information.

You can be your own judge, as it’s often obvious when your information should be given out. If it’s just to hook up a cell phone, your social security number is not necessary. If a credit check is ever required, you should be able to please the other party enough with a valid photo ID and one other credit card. Basically, to prevent identity theft, social security number is something you should never give out.

Also, maintain a list (with dates) to track when and to whom you gave any personal identifying information. This makes it a lot easier to find the culprit if you ever become the victim of identity theft.

13) Download an Antivirus Program

Many free anti-virus programs work well, whether you run a Chromebook, Mac, or Windows computer. Download one and make sure you keep your computer child-safe if there are children in your home. For example, if all your kids are young, make it so the administrator’s password must be entered to download anything. Further, maintain any personal documents on an administrator account and ensure no one has access to it.

14) Get Bank Monitoring

The last important paid service to make sure you have is bank monitoring. This consists of setting up alerts that trigger once your bank accounts are potentially used fraudulently. You cannot find this level of protection in every identity theft + credit monitoring package.

15) Limit Public Wi-Fi Use

Any public wireless network, such as at a hotel or restaurant, should be used with caution. As open networks are easier to hack into, it’s possible that a criminal could gain access to your computer, smartphone, or tablet. As such, you should not ever use a public network for online banking and payments or for any other accounts that involve your personal details. Plus, make sure you always delete the browsing history and cookies after using a guest computer or network.

16) Invest in a PO Box

Investing in a PO Box at your local post office is a great idea. This way, you do not have to worry about who sees your mail. There are no longer concerns of a neighbor or random person intercepting postage that contains personal identifying information. After all, stealing mail is one of the most common ways thieves get the information they need. It might be a bit of a pain, but considering the sensitive information that comes through the mail, it’s a smart investment.

Don’t know about PO boxes? They’re at your local post office and probably cost around $3 to $20 a month. So why not?

17) Invest in a Safe

It’s a good idea to purchase a safe for your personal items, whether they are documents or fine jewelry. A simple yet crack-proof and fire-resistant safe is best, and they do not run much more than $100 at entry-level. You can use this to keep any sensitive items, such as your passport and your social security card. This is especially valuable if you ever have a babysitter or cleaner in your home or if you just have many people passing through over time.

18) Limit Your Charitable Donations

Never donate a penny by phone. Always make sure to check the charity’s BBB rating and search online for terms like “charity name + forum” and “charity name + scam” to get an idea of the charity’s legitimacy. While many are trustworthy, some are just looking to pocket your cash. Fraudulent organizations will also take your personal information and credit card details to commit identity fraud in the worst cases.

19) Protect Your Kids

It’s important to secure both your and your children’s identities. After all, the estimate is 10.7% of minors have had their social security number used without their knowledge. This could be done by a relative trying to hook up utilities after getting cut off on their own or for financial gain. Regardless, an identity theft add-on for minors will ensure your children’s identity stays safe.

Section 2 – How to Prevent Student Identity Theft

College students are hot targets because it’s easy to victimize them. Think about it. Even your roommate’s mother could blindside you. With a not-so-private home life on campus and with so many people knowing so much about you, it’s clear you make a juicy target.

Before getting into our student-based tips, you might want to read our post on everything students have to know about identity theft before proceeding.

If you are a college student, here are 20 ways to prevent identity theft from impacting you.

20) Protect Your Parents

It’s normal to get help from your parents to finance school, qualify for loans, etc. If your parents helped you, then there should be some sort of paper trail. All these documents need to be kept hidden and secure. If they end up in the wrong hands, your parents could also become identity theft victims.

21) Hide Your Paperwork

You should not assume your documents are safe when living on campus. Find a hiding spot, get a storage unit or locker, or just leave your paperwork with a trusted relative. You already expose enough about yourself during the length of your course. It could just be a matter of a criminal seeing the right piece of paper to complete the puzzle, making you their victim. Remember, even paperwork like your school grades could include your social security number.

22) Consider Your Student ID

There is a growing crackdown on the way student identification numbers are generated. In previous years, many schools would take the student’s social security number and add a character. This means that everyone could gain access to each other social security numbers without even having to make any real effort. This might not apply to you, but check to see if your student ID matches up to your social security number at all. If it does, make sure to keep your card on lockdown or request a different number.

23) Limit Your Communications

It’s easy to let information slip when you have a roommate, professor, and school full of people you trust. But, it’s not always necessary to give up your private information. You do not need to hand over personal identifying information by phone. Make sure anything you give out is in person, and understand why it’s being recorded. Also, be cautious about what you include when inquiring to the school by e-mail. After all, something as simple as a server breach could reveal all your personal details to the intruder.

24) Redirect Your Mail

You might not feel important enough to bother with paying for a PO box. That’s okay. You can still protect your mail from unwanted eyes by redirecting it home. Either that or list your address with “In the care of” marked for the respective recipient. If you get many emails, or if your school is in a different city, then a PO box might be worth the investment.

25) Secure Your Computer

As a student, you will connect to public Wi-Fi networks regularly. This puts your computer at increased risk of getting attacked. As such, your school computer should not contain any sensitive information about you. The easiest way to ensure safety is by incorporating these:

- Antivirus/malware tool.

- Firewall.

- Private Internet connection.

- Backup of all your data.

26) Freeze Your Credit Report

It’s generally a good idea to put a ‘credit freeze’ on your credit report. Students will find even more benefit from doing so, as they are less likely to use their credit. The credit freeze will trigger a verification call if your name is ever used towards a new credit line. For better results, you can get a ‘security freeze,’ which goes a step further and factors in a verification code or PIN to approve any credit changes.

Read here and learn how to freeze your credit report.

You can also read up on the costs and laws by state here to figure out what to expect if you plan to place a security freeze on your file.

27) Don’t Help Your Roommate

It’s easy to feel the need to help your roommate with simple issues like qualifying for a new cell phone. But, you must understand that now is not the time to take on any liabilities on your credit file. The risks are too high, and you will be the first debt they ignore when things go sour. Plus, if you get a paper bill for their utility, that could be used towards opening fraudulent credit lines in your name.

28) Don’t Share Your ID

Once again, helping a roommate or school friend does not seem like a big problem. But, if you let them use your ID cards at any point, this could be a spell for disaster. For instance, if they get stopped by the police or arrested, your ID could get used, and your record would become tarnished.

29) Try CreditKarma Free Service

If you are a college student, chances are you do not have much borrowing history. If you qualify as a thin file, then you could get free services from CreditKarma. These services will not secure your identity, but free credit monitoring does help. And, it’s essentially taking steps to prevent identity theft free of charge.

Why CreditKarma?

30) Be Careful when Using Social Media

School is a place where socializing with others is considered the norm. Yet, the continuous influx of new connections to your social media profiles can be disastrous. You need to watch out for what you say and share while using social media. Otherwise, it’s essential to take the time to categorize your connections by trustworthiness. You can do this on Facebook, but most other social media websites do not offer this feature.

31) Protect Your Documents at Home

Identity thieves will strike whenever they are given a chance. This could come up at any point. So, you should make an effort to organize and hide any items back home that contain your personal identifying information. If you want to go a step further, sort through them and shred any no longer needed.

32) Don’t Carry Too Many IDs

You do not need to keep all your cards in your purse or wallet for the most part. Items like your social security number card are only important when they are actually needed. Your student ID will go a long way, yet it is a hard piece of identification for an identity thief to use. Long story short, you don’t need to drop the nightlife fun, just limit what a potential thief can access.

33) Be Careful with New Relationships

You need to remember that post-secondary schools are just platforms for learning, not fraud shelters. Identity thieves are of all ages, and in fact, most are young adults. This means the classrooms will contain possible fraudsters. Whether you are meeting a new friend, starting a new relationship, or otherwise, make sure you are cautious about what they can access.

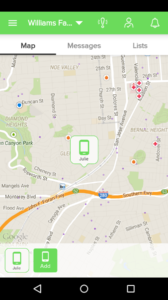

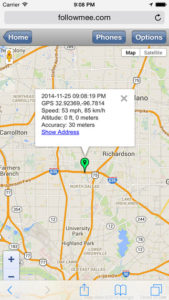

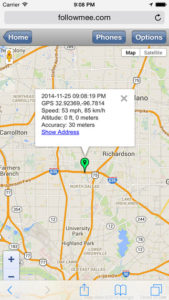

34) Track Your Smartphone

A smartphone is always crackable, do not let yourself be fooled. If someone steals it and gets into your phone, they might gain access to sensitive information. They could also contact your contacts requesting details, and you never know what could slip. But, you can lower the risk of this type of intrusion by using a tracking app.

If you have an Android, try to find my last phone.

If you have an iPhone, try the GPS location tracker.

35) Read Articles

As a college student, you are going to learn a lot about the world. You might find a new interest in the economy, politics, and other subjects that bored your high school mind. As such, you should try and stay up to date on the latest identity theft news. Do a bit of reading. We have many great articles here, and educate yourself on how identity thieves really work.

36) Don’t Share Browsing Sessions

It’s okay to share your computer with friends at school, but you should be careful about how you do it. The best bet is to make a ‘Guest’ account accessible for this purpose. But, it’s even more important for you not to share browsing sessions. Make sure your cache, cookies, and history get deleted before giving up your computer for a long period unless you are right there.

37) Avoid Sketchy Credit Card Offers

You are at the age where it’s a coin flip whether you currently have a credit card. There will be countless offers coming in the mail, including some that say you are pre-approved. You should be very careful with which ones you apply for, as some are complete scams. In fact, it’s even possible for a fraudulent credit card provider to mail an application form in anticipation of your personal identifying information.

38) Don’t Throw out Junk Mail

It might seem harmless to do, but you should not ever just throw junk mail into the trash. Of course, throwing out a store flyer is a different scenario. But, whenever you get any credit card offers or anything else directly linked to your name, it’s best to shred them first. After all, school dumpsters make for perfect breeding grounds for dedicated identity thieves.

39) Avoid Sharing Your Phone

It’s easy to think of all the benefits of sharing a phone with your roommate, but few downfalls are obvious. Yet, believe it or not, it’s possible to become an identity theft victim this way. This is because the use of telephone verification is prevalent in many businesses. This is not just true for places like movie rental stores. With access to your phone and a lot of information about you, things could take a turn for the worst.

Section 3 – How to Prevent Child Identity Theft

Children are easy identity theft targets as they have no bad credit past, and the fraud can run unnoticed for many years. As a parent, it is your responsibility to ensure they do not get targeted during their younger years. It’s also imperative that you teach them about the seriousness of identity theft as they get older.

If you are super concerned, don’t forget to check out our advanced article: 10 tips to ensure your child’s identity stays safe.

Here are some steps to prevent identity theft from harming your child’s identity.

40) Get Child Identity Theft Protection

There are no bulletproof ways to ensure your child is never the victim of identity theft. But, securing their identity through a child identity theft protection plan would be wise. Make sure you are careful with where you invest in identity protection. Some providers don’t offer protection to minors, so you’ll have to plan ahead of time; however, you can usually find a ‘family plan’ to cover your kids and spouse at a discounted rate.

41) Dispose or Lock up Their Mail

Over the years, there will be many different pieces of paperwork about your child that will show up in the mail. Some will be important to keep, while other documents you will be able to shred. Make sure you don’t just stow everything away in a ‘miscellaneous drawer’ in your kitchen.

42) Teach Your Child about Identity Theft

This is not a subject kids learn from their friends or teachers. It goes without discussion until it’s too late. You can do all the work to keep them safe when they are little, but it’s a whole new game when high school hits. Since the subject can be overwhelming at times, make sure to cover the most important details.

43) Don’t Co-sign a Credit Card

One of many parents’ biggest mistakes is co-signing for a credit card before their child is ready. This can have a huge financial bearing on both parties involved. It might seem like a good idea at first, but you are better off putting up the collateral for a secured card to help them get started. Especially in college, it’s too easy for your child’s credit card to slip into the wrong hands.

44) Make a Parenting Agreement

If your child’s other parent is no longer living with you, your efforts must run fluently in both homes. This means you both need to have an understanding of how to protect your child’s identity. This includes considering many aspects, such as where personal identifying documents get stored and what the child carries between homes.

45) Have The Pre-college Talk

College students are indeed top identity theft targets. You should talk with your child about the new risks they are exposed to once in college. Ensure they know to keep their dorm door locked, not trust anyone, and preferably keep important paperwork at home. As it’s not something your child will think about, make sure to offer them to keep their mailing address at home.

46) Advise Them on Internet Safety

Identity thieves target many children through the Web. It would shock you just how easy it is for a fraudster to trick kids into giving up sensitive information online. Make sure you educate your child on what is okay and what’s not if they browse the Web. It’s also a good idea to block your child from access to P2P file-sharing networks (like BitTorrent), as they are proven tools for identity thieves.

47) Check Your Child Credit Report

Right now, you are probably thinking, “my child does not have a credit report?” and hopefully, that’s true. Considering more than 1 in 10 children get victimized, it’s never a surprise to find out your child was targeted. If one is presented back by requesting a credit report, you will have a good idea of whether they were victimized already. If you want sanity of mind, you can spend a few dollars a month on a children’s identity theft protection plan.

You can request information on your child’s credit report (if one was created) by filling out the form at the respective credit bureau; here’s the special form request page for the three major credit bureaus:

- Equifax

- Experian

- TransUnion

48) Never Allow The Theft to Happen

While identity thieves frequently target minors, part of the statistic comes from parents and other relatives being fraudsters. There have been many cases where parents could not get a phone or utility in their name, so they stole their child’s identity to make it happen. This is something you should never do yourself, and it’s also something you should never permit others around you to do.

49) Always Emphasize Password Security

Your child will be connected to the online world at some point. Whether that happened already or not, make sure you explain password security to them. But, don’t just focus on the importance of a hard-to-guess password. There are many security loopholes an intruder could use. For example, it’s easy to find the answer to “What’s your mother’s hometown?” so it’s a problematic security question for them to use.

Here are some good password choosing tips.

You should use:

- Many characters;

- Upper and lower case letters;

- Multiple numbers and symbols;

- Combinations of these.

Of course, make sure to use a unique password at each site instead of relying on the same one.

Section 4 – How to Prevent Identity Theft Out of The US

Travelers are easy and unsuspecting targets for identity theft. When on vacation, the last thing you have on your mind is the risk of your identity getting stolen. Yet, there are countless ways for it to happen and in fact, you are more exposed to the risk while traveling abroad. So, make sure to read each of these tips to become more informed on preventing identity theft while traveling abroad.

50) Keep Your Credit Card Away

To make things easy, all you have to do is make sure you do not pull out your credit card during your travels. It’s okay to bring it in case of emergencies, just don’t use it for any other reason. If you need to pay for something, your best bet is to pay in cash. This is especially true in countries with weaker economies, with more incentive to pull schemes like card skimming at the cash.

51) Make a Note of Everything You Have

It’s easy to forget or lose something when you go on vacation. So, write down or take a picture of all the important cards and paperwork you will bring. Then, double-check before you pack up to head home, and once you get home, make sure it’s all still there.

52) Leave What You Can at Home

Many of us are guilty of having an overstuffed purse or wallet. When, in fact, there are many items that you do not have to bring for your trip. Go through everything you have and leave what you can at home. You can just put it back in your purse or wallet once you return from your trip. This will create a much smaller burden if something bad happens. For example, you have no idea how much of a headache you would experience when trying to prevent identity theft after a wallet is stolen or misplaced.

53) Be Cautious with Public Wi-Fi Connections

Public Wi-Fi networks are honeypots for identity thieves and should be avoided whenever possible. At the very least, they should not be used for any online banking or other identifiable accounts. This also applies when staying at a hotel, where passwords remain the same, and anyone could break into the connection to attack an unknowing guest. Further, as it’s easy to break into accounts over public connections, you might want to make a new e-mail account specifically for your travels.

54) Avoid Any Non-Bank ATMs

If you need to get cash from your credit card, you should avoid doing so through any non-bank ATMs. These are too easy to access and modify for fraudulence. By going to a machine at an actual bank, you will stand a much lower chance of being exposed to identity theft.

55) Protect Your Smartphone

Your smartphone can be a dangerous tool for an identity thief to happen upon, supposing you lose it while traveling abroad. Make sure you plan by securing your phone in as many ways as possible. Back up any sensitive files on your computer and wipe them from your phone. Make sure a complex password is used. As mentioned earlier, install a tracking app to help locate your phone if it gets lost or stolen. Some of these apps will even allow you to lock or wipe your phone remotely.

56) Be Picky about Hotels

There are many places you can stay while traveling, but not all of them will be safe. Some will have untrustworthy housekeeping staff. Others will have someone at the front desk looking to skim your credit card. Your best bet is to stick to the best places and check on a website like TripAdvisor to ensure the place is trusted. You already know most places will ask for your credit card for security purposes, so avoid giving it up at any smaller, lesser-known places.

57) Contact Your Credit Card Provider

Before leaving for your trip, get in touch with your credit card provider. Let them know where you will be traveling and what type of spending you will make. Credit card companies watch for potential fraud transactions, and traveling abroad will raise red flags. They just have to contact you if an obvious fraud transaction shows by notifying them ahead of time. Further, if you get a call about your credit card, make sure it is not an imposter and request to call back at their extension number.

58) Consider a Virtual Private Network (VPN)

You do not have to be a tech nerd to understand how to set up a virtual private network or VPN. It is explained in a step-by-step guide through almost every provider. So, you can keep your network connection secure for the cost of around $5 per month. These networks encrypt the information transmitted from your wireless device, so hackers have a much harder time targeting you. Do your own research first. A few top providers are ExpressVPN, Private Internet Access, Boleh VPN, and IP Vanish VPN.

59) Use Tyvek Sleeves

Identity thieves love committing credit fraud against unsuspecting tourists. It takes forever for them to notice the issue, and any red flags from the card provider get blamed on the foreign transactions. Yet, local identity thieves could skim your credit card information by using electronic scanners. Tyvek sleeves block out the radio frequency transfer, making it almost impossible for fraudsters to target you this way.

Section 5 – How to Prevent Identity Theft Online

Internet users are always at risk of having their identity stolen. Whether from the sites they browse or the applications they download, a thief will always find an entry point. Many security flaws exist, and most are due to personal ignorance, so read these tips to understand better how to prevent identity theft online.

If you want to stay super safe, check out our advanced guides on various Internet identity theft techniques to learn how you could get exploited. You can find some of them in our post about social engineering identity theft.

With that said, here are some specific tips to help you stay safe on the Web …

60) Get an Effective Antivirus Program

It’s easy to become the victim of identity theft if your computer gets infected with a virus. In fact, if it’s a keylogger, the attacker could read every single keystroke you make. Free anti-virus programs like AVG, Bitdefender, and Malwarebytes are all trustworthy. Look for reviews and check the specific features of each offer, then download one onto your PC. This will come in handy when trying to prevent identity theft on social networks, as you will be protected from clickbait viruses.

61) Clean Your Desktop and Inbox Periodically

Many of us are guilty of letting emails pile up and forgetting about old documents and images on our desktops. This is mostly just innocent laziness, but sometimes it creates a serious security risk. You never know when or how your computer will get compromised, so you should do all you can to keep it safe. Any super sensitive data that must last a while can get stored on a USB stick or alternate hard drive. As for sensitive messages in your inbox, you must also make sure to check your ‘Sent’ messages during your clean-up.

62) Download OpenDNS and Use Phishtank

OpenDNS works to boost your Internet speed by taking over the page detection and load process that your Internet service provider usually does. Further, the Phishtank function allows you to block out phishing websites. If a website is considered dangerous, a warning page will be presented to you. This is perfect for trying to prevent identity theft on social networks, where you will often find yourself hopping off-site to view news stories from websites you’ve never visited.

63) Use The Web of Trust to Check an Online Retailer Trustworthiness

Some online stores are easy to trust (Amazon, Walmart, etc.), while others are a coin flip. That should not stop you from finding the best deals and all the items you want. You can use the Web of Trust (WoT) to determine whether an online store is trustworthy. This is perfect for Chrome users, as there is a downloadable plugin that automatically shows the reputation rating for each website you visit.

64) Don’t Use Your Credit Card Online

The absolute best way to avoid identity theft on the Internet is never to enter your credit card details for any reason. This can be difficult because most online stores offer few payment options. But, you can always upload funds to PayPal from your bank to buy off the majority of reputable shops. Further, alternative payment methods like Google Pay and Bitcoin can serve as effective ways to pay without giving up your credit card numbers.

65) Be Cautious on Social Media

Many make the mistake of divulging too much personal identifying information over their social media accounts. Even worse, some do not have the appropriate security measures in place to ensure only their real connections can see what they share. A horrible example of this was the paycheck selfies incident that caused numerous identity theft attacks in previous years. So, make sure you are careful not to give out too much about yourself. Further, tighten the privacy settings of your accounts to help prevent identity theft on social networks.

66) Make Sure Your Wireless Network is Secure

An open network is like an open door with no one at home. It just leaves you begging for a hacker to come in and steal your identifiable credentials. Make sure you secure your network, such as with WPA encryption. Make it password protected. Use a complex password, various letters, numbers, and special characters. This will greatly reduce the risk of an outside attack on your network, which could make all the difference in keeping yourself safe from identity theft.

67) Stay away from File Sharing Networks

Peer-to-peer file-sharing networks might be convenient, but they should be avoided for safety reasons. It’s possible that you download an infected file, which could allow the attacker to access all your documents and images. If anything sensitive is there, this could potentially cause you to become the victim of identity theft.

68) Make Use of OnGuard Online

The United States government offers a website that discusses how best to protect yourself and your children on the Internet. This is called OnGuard Online, and it includes endless information on common scams, identity theft tricks, computer viruses, and much more. It is a great resource if you want to understand better how to stay safe from identity theft; this is also a good source of information to provide your kids when they become regular Internet users.

69) Avoid Opening Sketchy Messages

Spam mail is usually easy to identify, but sometimes it can get a little tricky. If there are any attachments and you do not know the sender, avoid opening them on your computer. It’s easy for the sender to track you through the image’s ‘metadata,’ which could reveal information about you. One of the biggest parts of avoiding identity theft through your social accounts is knowing how to spot such messages and posts. Be careful and take the time to comprehend what anyone sends or shares to you, then open it once you feel safe.

70) Set up a Google Alert

You never know when your accounts become compromised. Sometimes the information ends up dumped on a random hacking forum. By setting up a Google alert with your e-mail address, you will be able to find out if your information ever gets shared.

71) Avoid Online Payday Loans

There are many payday loan websites that were just set up as information grabbers. Some later post the entire details of their registrants on the Internet. This includes information like your full name and mailing address. The payday loan company could not only end up stealing your identity, but other criminals could also end up accessing the information.

72) Be Careful on Other People Computers

When you use your own computer, you have full control over the security layers in place. This is not the case when using someone else’s computer, whether a friend’s or one at an Internet cafe. As such, you need to be extra cautious about the accounts you access and the information you enter. You can also use a VPN, which gives you additional security.

Just use common sense; don’t do your online shopping at a library, always delete cache, cookies, and history when you are done, etc. To prevent identity theft triggered by information gathered from your accounts on social networks, you might want to avoid logging in from foreign devices.

73) Be Cautious when Clicking Links

Viral websites are a dime a dozen, and you just never know when one will redirect you to a fraudulent page. This could be a loop-around to a Facebook phishing site, or the website could auto-install a browser hijacker, and so on. It’s cool to see all the different viral stories on Facebook, but your best bet is to avoid most of them. A few are trusted, such as Buzzfeed, but you will have to be selective to ensure you prevent identity theft when browsing social network feeds.

74) Be Cautious of Social Media Apps

There are many apps on websites like Facebook and Twitter that are either fun or helpful to use. While most are fine, a couple will still gain access to your social media account for fraudulent purposes. As such, you must keep an eye on what type of privileges you are giving the app when you attach it to your social media account. Sometimes you can avoid certain settings by selecting the ‘Not Now’ option when Facebook apps request the right to post AS YOU on your page.

75) Be Smart when Choosing Passwords

It’s important to understand that the passwords you choose will seriously impact your Internet safety. This goes much further than just how complex the password you choose for your important accounts. Further, you need to ensure that you do not use the same password for all of your accounts. For example, you might sign up at a gaming forum that gets hacked, and your e-mail and other accounts could end up compromised as a result.

76) Try to Avoid Password Managers

It’s really convenient just to let your browser remember all your different passwords. Yet, no one really knows how safe these password managers are, and it’s a subject that’s certainly up for debate. That said, there are no immediate worries, but if something like the ‘Heartbleed bug’ happened again, you never know how well your password manager’s encryption will hold up.

77) Always Monitor Your Child Online Activity

You do not just have to worry about your identity getting stolen because of your child downloading infectious files. If your child browses the Internet, they might also make the mistake of sharing too much about themselves. This could create a disastrous situation, so you should censor certain websites to keep them safe. You can buy parental software to have maximum control over your child’s Internet use and safety. Further, you will need to advise your child on the importance of preventing identity theft and how their social media use can impact their safety.

78) Use Two-Factor Authentication

It’s recommended that you use two-factor authentication to keep your accounts as safe and secure as possible. Many services offer this, but it is easiest to use GAuth Authenticator from Google. This service makes it so that you can verify through a second factor by entering a code sent by text to your phone. This creates a further layer to keep hackers out of your accounts, and while it’s not bulletproof, it works great.

79) Educate Yourself Online

The Internet is a great resource for information about identity theft and how it can be prevented. You can find endless educational articles online. Take a few minutes to search the Web for answers to any questions you might have.

Section 6 – How to Prevent Business Identity Theft

Professionals and investors are always hot targets for identity thieves as they have an extensive amount of money (and credit lines) that can be compromised. Whether you build websites, buy stocks, or speculate on other online investments, there are certain extra security steps you should take.

80) Designate a Work or Investment Computer

Whenever you have a lot of money or digital assets at stake, your computer’s security becomes of the utmost importance. This is why it’s worth spending even just $300 to pick up a new computer for your financial matters. After doing so, make sure to implement a quality anti-virus program and make other changes to make it more secure. Although, you could always buy a Chromebook or Macbook as both are known for keeping viruses out.

81) Get Advice from BusinessIDTheft.org

We typically don’t recommend other websites that advise on identity theft protection, but for businesses, BusinessIDTheft.org is the best resource around. This website gives you access to endless information on how identity thieves attack businesses, how it can be prevented, and what can be done after an attack happens. We support this website as it is backed by many high-profile corporations and organizations, including the Identity Theft Protection Association and the National Association of Secretaries of State, as well as many others.

82) Keep Your Computer Physically Safe

Beyond the pass protection and anti-virus layers comes an even more important factor, which is the physical safety of your computer. You might not be an infamous investor or website builder, but you never know where your ventures will take you. It’s easy to locate a domain owner’s exact address, so even if you just have a blog that turns wildly successful, you could be targeted in real life. This is why high-profile names like Edward Snowden (CIA whistle-blower) used the Tails operating system. With the pull of a USB stick, all the computer contents were no longer accessible.

83) Invest in Whois Domain Privacy Protection

Since the Whois results for a domain registrant show the person’s full name, mailing address, and phone number, it’s best to keep this private. Some domain registrars offer free Whois privacy for the first year of a domain’s registration. Others will charge upwards of $10 per year for this service. Either way, you will want to implement it to ensure there is as little identifying information about you on the Web as possible.

84) Be Careful What You Disclose Online

It’s standard to discuss your investment interests on the Web with others like you. Whether this is done on a domain investing forum, a cryptocurrency IRC chat room, or otherwise, your security is still important. As such, you should only access and communicate on such websites through a VPN-protected connection. Further, it’s recommended that you attempt to minimize the amount of linking between your online accounts and your offline identity.

85) Watch out for Property Rental Schemes

When looking to invest, whether in a rental, rent-to-own, or purchase, there are a few ways the landlord or seller could defraud you. One of those involves getting you to complete a rental application over the Internet. This allows the other party to receive a lot of personal identifying information about you without meeting. While this paperwork should always be done in person, the excuses to avoid doing so usually make the scam obvious. To further check the authenticity of a property offer, just go to Google Images, hit the camera symbol, and enter the image URL.

86) Protect Your Business from Fraudulent Transactions

Whether by stealing banking details or using spyware, a fraudster could potentially commit identity theft to make fraudulent transfers from your business’s bank account. This makes for a huge out-of-pocket loss, and usually, the funds are never recovered. To prevent this, make sure you have the appropriate security and verification in place for such transfers. Two-factor authentication is a good start, and it can be used to enforce two agreeing parties to push any transfer forward. Further, your bank might offer a multi-authentication method that involves unique tokens, faxing, and many other types of verification procedures.

87) Send Checks with Positive Pay

Paper checks have always been a serious concern when it comes to identity theft. Now, American professionals have the ability to pay by check through Positive Pay. This system allows you to state what checks were sent out, meaning anyone cashing a check from you must be authorized to do so first. If a check does not match, but it’s a legit payment, your company can get an image of it by fax to manually approve. As forged checks are always a possible financial risk for businesses, this service can be a true lifesaver and is essentially a form of liability insurance.

88) Keep All Business Paperwork Locked up

Your checks serve as tools for identity thieves, so your company’s checkbook should be kept hidden at all times. The same is true for other types of business paperwork, such as deposit slips and endorsement stamps. Anything that ties to your checking account, your own identity, and anything else that identifies sensitive information should be stored securely. A lockbox or safe is the best bet, as it’s easy to break into a locked filing cabinet.

89) Hire The Right Accountant

If you hire some cheap accountant at Kijiji to handle your confidential information, that low-cost service could become very pricey down the road. Accountants have tons of sensitive business info and, if they wanted to, it could easily be used to commit identity theft. So it might be worth it not just to choose an accountant based on affordability; for best results, look for a top-rated accountant in your area.

Section 7 – How to Recover From Identity Theft

Identity theft victims never know what to do when they first find out they were victimized. That’s why it’s important to know how to prevent these crimes and what to do if they cannot be stopped. So our last 10 tips are dedicated exactly to that.

90) Make a Complaint to The Federal Trade Commission (FTC)

You need to file a complaint with the FTC about your identity theft case. Go to the FTC Complaint Assistant and select the ‘Identity Theft’ option. From there, notify the FTC of whether someone already used your identity, if they tried to, if your information was compromised in a data breach, or if your purse or wallet was lost or stolen. They will walk you through the complaint process once you specify your identity theft situation.

91) Contact Your Local Police Department

Your next step is to submit a police report to your local police department. Make sure to bring the FTC Identity Theft Affidavit you receive from filing your FTC complaint. Provide any other evidence you can find, such as bank statements, fraudulent transaction recipients, and IP addresses used to access your compromised accounts. Remember, you can file a police report even if you just assume an identity theft was attempted. For example, you can show a debt collection letter as evidence of potential identity theft if it was fraudulently put in your name.

92) Contact Your Bank and Creditors

Whenever you have become the victim of identity theft, you need to contact all involved parties. For instance, if credit fraud were involved, you would need to call your credit card company to inform them of the crime. They might request the FTC Identity Theft Affidavit as proof of your claim. But, thankfully, the Fair Credit Billing Act states that you will not be held responsible for more than $50 of losses if you were victimized this way.

93) Place a Fraud Alert on Your Credit File

Once an identity thief strikes, they have the information on you that they need to continue doing so for years to come. As such, you should place a fraud alert on your credit file to prevent this from happening again. With a fraud alert in place, you will get notified if any new credit lines are opened in your name. This gives you the chance to verify the action or declare it too as fraudulent. The fraud alert will last 90 days on your file, but it can be renewed at the end of that term.

94) Consider a Full Security Freeze

Instead, you can perform a ‘security freeze’ on your credit file if you are confident that the attacker will strike again. This might come with a $10 cost, but that’s often wiped when you prove an identity thief victimized you. The security freeze will prevent any creditors from pulling your credit file without your authorized permission. You can decide whenever you want to take the freeze off your file, and it can be put back at any time. To prevent identity theft, freeze credit and not lift the freeze until you know your identity is secure.

95) Inform The Three Credit Bureaus

You need to let Equifax, Experian, and TransUnion know that you were the victim of identity theft. When doing this, you must also show them the FTC Identity Theft Affidavit, your police report, and any other important information. From there, the credit bureaus will pay closer attention to what shows up on your credit report. Of course, you should still keep a close eye on what posts. You never know when the fraudster will strike again.

96) Do a Security Audit of Yourself

The identity thief was able to compromise your information and use it fraudulently. There has to be a reason behind how they obtained the information in the first place. If you are unsure, the best place to start is your computer. Check for any malware, viruses, and compromised online accounts. For instance, websites like Facebook.com and Live.com allow you to see what IP addresses and devices have previously signed into your account. Clean out your computer, change your passwords, and do everything you can to make your identity more secure for the future.

97) Inform Your Service Providers

Whether the electricity company or your home phone service provider, you must let them know about the attack. This is because you do not want your service bills being used to open new bank accounts and credit lines fraudulently. As this paperwork serves as a ‘proof of residence,’ it’s best to request it not be mailed out to your current address. Unless you know the identity thief targeted you online, it’s fair to assume someone could be stealing your mail or rummaging your trash.

98) Phone The Office of The Inspector General

You must let the Inspector General Office know that your social security number was used in fraudulence. This makes it easier to detect if the identity thief attempted to defraud you of any type of benefits, your pension funds, etc. You can also request a printout of your various statements to double-check that all the numbers are still accurate.

99) Request Replacement Debit, Credit, and Identification Cards

You need to take the time to replace all your different cards. Of course, if you had good ID protection, then you could just let your provider do all the dirty work. If not, just head into your branch when you first inform them of the issue and request a new debit card at the same time. Contact your credit card providers by phone and request new cards. Further, make sure to get a new driver’s license and replace any other government-issued photo ID as the thieves could already use replicas.

100) Monitor Your Credit Closely

From hereon, you will be faced with a tough challenge. As an identity theft victim, your personal information is in the hands of someone who has attempted to benefit from defrauding you. This is something that will probably go on for many years to come. So, it’s a good idea to throw credit monitoring on top of your identity theft protection plan.

So, there you have it…to prevent identity theft, tips like these are necessary to follow. None will guarantee that you will never become a victim, but at least a protection plan will take financial responsibility. It’s a cruel world where even more than 1 in 10 children are victimized by identity thieves. So, you need to do what you can to protect yourself, and applying some of the advice here will make for a pretty good start!

That said, there is no doubt that the low cost of identity theft protection makes it a worthwhile investment. It takes all the responsibility and liability away from you, meaning you don’t even have to worry about how to avoid identity theft on your own. So, if you are interested in identity theft protection, take a look below at the most trusted service providers around.

Have a question that’s not answered here? Feel free to comment below, and we’ll try to help out!

Best Loans is Alaska

Best Loans is Alaska  Best Loans is Arizona

Best Loans is Arizona  Best Loans is Arkansas

Best Loans is Arkansas  Best Loans is California

Best Loans is California  Best Loans is Colorado

Best Loans is Colorado  Best Loans is Connecticut

Best Loans is Connecticut  Best Loans is Delaware

Best Loans is Delaware  Best Loans is Florida

Best Loans is Florida  Best Loans is Georgia

Best Loans is Georgia  Best Loans is Hawaii

Best Loans is Hawaii  Best Loans is Idaho

Best Loans is Idaho  Best Loans is Illinois

Best Loans is Illinois  Best Loans is Indiana

Best Loans is Indiana  Best Loans is Iowa

Best Loans is Iowa  Best Loans is Kansas

Best Loans is Kansas  Best Loans is Kentucky

Best Loans is Kentucky  Best Loans is Maine

Best Loans is Maine  Best Loans is Maryland

Best Loans is Maryland  Best Loans is Massachusetts

Best Loans is Massachusetts  Best Loans is Minnesota

Best Loans is Minnesota  Best Loans is Missouri

Best Loans is Missouri  Best Loans is Michigan

Best Loans is Michigan  Best Loans is Mississippi

Best Loans is Mississippi  Best Loans is Montana

Best Loans is Montana  Best Loans is Louisiana

Best Loans is Louisiana  Best Loans is Nebraska

Best Loans is Nebraska  Best Loans is Nevada

Best Loans is Nevada  Best Loans is New Hampshire

Best Loans is New Hampshire  Best Loans is New Jersey

Best Loans is New Jersey  Best Loans is New York

Best Loans is New York  Best Loans is New Mexico

Best Loans is New Mexico  Best Loans is North Dakota

Best Loans is North Dakota  Best Loans is North Carolina

Best Loans is North Carolina  Best Loans is Ohio

Best Loans is Ohio  Best Loans is Oklahoma

Best Loans is Oklahoma  Best Loans is Oregon

Best Loans is Oregon  Best Loans is Pennsylvania

Best Loans is Pennsylvania  Best Loans is Rhode Island

Best Loans is Rhode Island  Best Loans is South Carolina

Best Loans is South Carolina  Best Loans is South Dakota

Best Loans is South Dakota  Best Loans is Tennessee

Best Loans is Tennessee  Best Loans is Texas

Best Loans is Texas  Best Loans is Utah

Best Loans is Utah  Best Loans is Vermont

Best Loans is Vermont  Best Loans is Virginia

Best Loans is Virginia  Best Loans is Washington

Best Loans is Washington  Best Loans is Wisconsin

Best Loans is Wisconsin  Best Loans is West Virginia

Best Loans is West Virginia  Best Loans is Wyoming

Best Loans is Wyoming